With Peppol, invoices are sent directly to your trading partner’s software using their ABN, so the right information gets to the right contact in seconds. Peppol eInvoicing is a common eInvoicing standard in Australia that has also been adopted by the Australian Government.

#INVOICES FOR BUSINESS MANUAL#

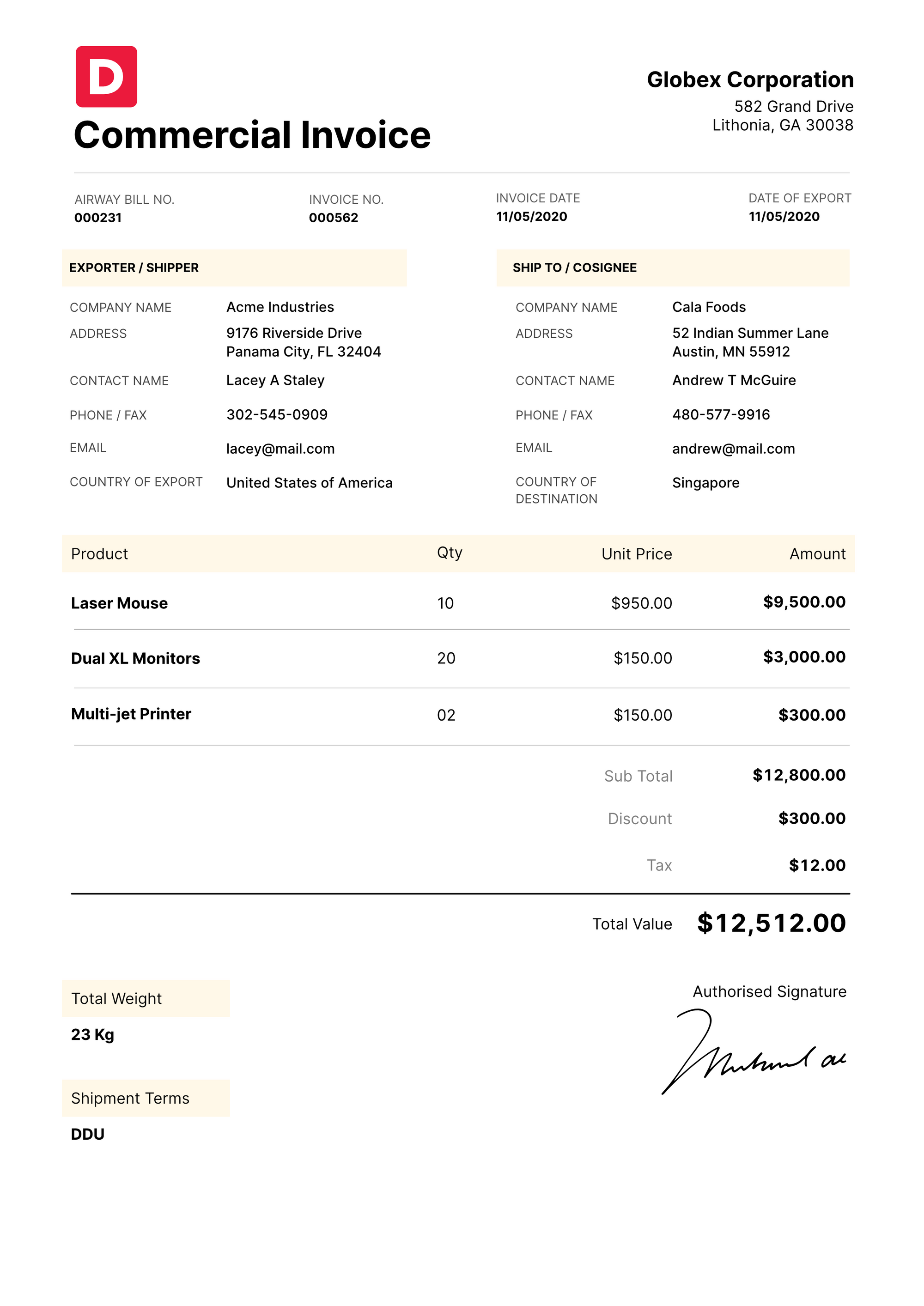

It removes the need for manual entry, reduces errors, limits missing and incorrect information and eliminates lost invoices.ĮInvoicing is becoming increasingly available through software products and is inexpensive, so getting started is easy. Standard tax invoice template Word | Excel New: eInvoicingĮlectronic invoicing (or eInvoicing) is the automated digital exchange of invoice information between suppliers' and buyers' software through a secure network.ĮInvoicing streamlines the exchange and processing of invoices, with invoices automatically appearing in your accounting software. Refer to the ATO website for more information You must be registered for GST with the ATO to claim GST. Where you are claiming GST you must ensure you provide a valid tax invoice. Standard basic invoice template Word | Excel Refer to the Australian Tax Office (ATO) website for more information If you are an individual (not a business) you may be required to complete a ‘Statement by a supplier not quoting an ABN’. Below are some templates that you can use to create a basic or tax invoice.Ī basic invoice can be used if you are not registered for GST or if you are an individual. If you need help in creating an invoice you can contact your accountant or financial professional for assistance. Some businesses find that they need to issue invoices regularly as part of their normal business activities, while for others, issuing an invoice may be rare. Partnership – advantages and disadvantagesĬo-operative - advantages and disadvantagesĪn invoice, which may also be referred to as a ‘bill’, is a list of goods and / or services provided along with the financial amount due to be paid.

Sole proprietorship – advantages and disadvantages What type of employee best suits your needs? Tendering for Government business…why do it?

0 kommentar(er)

0 kommentar(er)